How US LNG Is Replacing Russian Gas in Europe: The Strategic Role of Greece’s New LNG Route to Ukraine

By Artor Cara

Introduction:

Since the start of Russia's invasion of Ukraine in February 2022, the energy landscape in Europe has experienced a rapid transformation. Various countries across Europe have moved quickly to reduce their dependence on Russian pipeline gas and in turn have sought alternative suppliers to secure their energy needs. This shift has enabled US Liquefied Natural Gas (LNG) to rapidly expand its presence across European markets and thus emerge as the primary replacement for Russian supplies.

At the same time, new transit routes have grown in importance. Greece, in particular, has become a key entry point for US LNG moving into Eastern Europe, including Ukraine. This new role is reshaping regional energy security and influencing the broader geopolitical environment within Europe.

Europe’s Pre-War Dependence on Russian Gas:

Before Russia’s full-scale invasion of Ukraine in 2022, Europe was heavily reliant on Russian gas. In 2021, nearly 45% of all European Union’s (EU) gas imports came from Russia alone (1). Moreover, Ukraine played a central role in this supply as until 2022, European markets received between 82 bcm and 93.4 bcm annually of Russian natural gas through Ukraine (2). Overall, this shows how dominant Russia was in providing gas for Europe. Russian gas flowed through major pipelines like Nord Stream directly to Germany, TurkStream to the Balkans and the traditional routes via Ukraine.

However, the dependence on Russian gas created significant strategic risks for Europe. As seen in 2014 during the Crimea crisis, Russian natural gas producer Gazprom raised the gas prices for Ukraine twice in one week, almost doubling the cost in just three days (3). Ukraine’s economy and energy system were particularly exposed, thus in turn showing how vulnerable it was to political pressure or supply disruptions. As a result, Europe as a whole faced a substantial risk that any escalation with Russia could directly affect gas flows and energy security across the continent.

The Shift Towards US LNG:

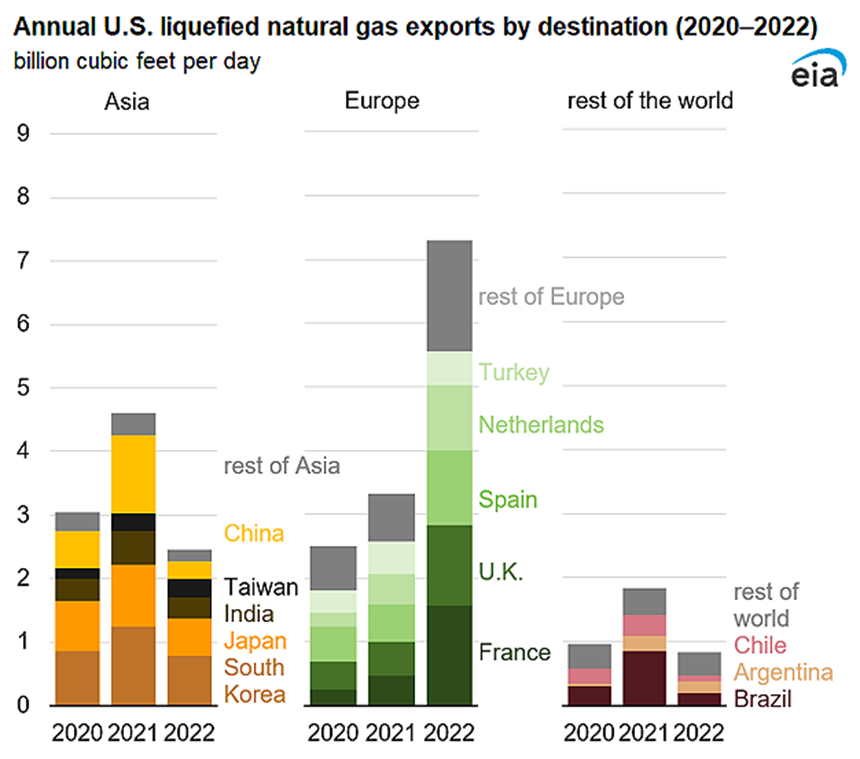

Figure 1 – U.S. Energy Information Administration (4)

As displayed in Figure 1, the US sent most of LNG exports to Asia 2020 and 2021. However, this considerably changed when Russia’s invasion of Ukraine occurred in early 2022. The US went from exporting roughly 3.4 Bcf per day in 2021 to 7.3 Bcf per day to Europe in 2022. This over doubling of volumes within a year exhibited both the scale of Europe’s supply crisis and the speed at which US LNG stepped in to fill the gap. As a result, this shift had clear ripple effects across global gas flows, as Asia and Latin America received a smaller share of US exports while Europe absorbed the overwhelming majority of available volumes.

In addition to securing higher volumes of US LNG, Europe also pursued a new policy called REPowerEU. This plan was launched in May 2022 and aimed to phase out Russian fossil fuel imports by focusing on: saving energy, producing clean energy and diversifying energy supplies (5). US LNG aligned directly with this diversification pillar.

The US became the preferred replacement supplier, for Russian gas, for three key reasons. First, the US’s sheer production capacity allowed it to rapidly increase exports to Europe and therefore avoided the long delays that would occur with developing new gas fields elsewhere. Second, LNG shipments offered a high level of flexibility, as cargos could be quickly rerouted to Europe when demand surged. Finally, as a democratic and long-standing strategic partner of Europe, the US was viewed as a politically reliable supplier. This ultimately reduced the risk of energy being used as a tool of pressure, as had been the case with Russia. Overall, these factors made US LNG a core part of Europe’s rapid efforts to diversify and secure its energy supply after Russian’s invasion of Ukraine.

Greece as a Strategic LNG Hub:

Greece has emerged as a strategic LNG hub for Southern and Eastern Europe and there are several reasons for this. Greece’s on-shore Revithoussa terminal near Athens, received upgrades, in 2018, with a third tank which boosted the facility’s storage capacity to 225,000 m³ in total and regasification capacity jumping by 40% (6). More recently, the terminal’s capacity was further enhanced in 2022, with the addition of a floating storage unit (FSU) moored nearby. This increased total storage to around 370,000 m³, roughly a 70% boost (7).

In addition to Revithoussa, Greece also added a second terminal: the Alexandroupolis FSRU, which began commercial operations in October 2024 (8). The FSRU can store 153,500 m³ of LNG and re-gasify up to 23 million m³ per day, adding around 5.5 B m³ annually to Greece’s gas transmission system (9). This addition significantly enhances Greece’s ability to supply gas domestically and to countries in Southern and Eastern Europe.

Greece’s geographic position also provides a distinct advantage as it is located at the intersection of the Eastern Mediterranean and the Balkans. Therefore, it provides direct access to major shipping lanes and the Aegean and Ionian Seas, enabling efficient transport to Southern and Eastern Europe. Furthermore, being a NATO member and surrounded by fellow NATO countries, Greece benefits from additional security guarantees and thus makes it a reliable and stable transit point for LNG.

This combination of upgraded infrastructure, strategic location and security makes positions Greece a key LNG gateway not just for receiving exports from the US but also for distributing gas efficiently to Eastern and Southern European countries, including Ukraine.

Implications for Ukraine:

On 17th November 2025, Greece signed a deal with Ukraine to supply US LNG to the country amid the damage to its energy infrastructure that have been caused by Russian attacks (10). Under this new agreement, US LNG from Greece’s Revithoussa terminal will reach Ukraine this winter via the new “Vertical Corridor” connecting Greece, Bulgaria, Romania and Moldova (11). This new supply route reduces Ukraine’s vulnerability to supply disruptions and fundamentally improves short-term resilience for when domestic production and storage capacity are under the greatest strain during the upcoming harsh winter months. By accessing LNG through a multi-state transit route rather than a single pipeline system, Ukraine significantly lowers the risk that any one disruption or political decision can completely stop supply. This diversification is greatly beneficial given Russia’s repeated use of energy infrastructure as a tool of pressure.

However, this deal also carries new pricing and reliability implications as LNG is generally more expensive than pre-war Russian pipeline gas. Despite this, the strategic benefit for Ukraine outweighs the cost premium in the short term, particularly whilst it continues fighting a full-scale war. Obtaining LNG through the multi-country transit system additionally adds logistical complexity and increases exposure to coordination risks which could hinder full capacity utilisation or delay deliveries during periods of peak demand.

Beyond short-term cost and coordination challenges, the long-run strategic value of this shift lies in how it restructures Ukraine’s position within the wider European gas market. Access to globally traded LNG reduces considerable exposure to Russia’s price manipulation and thereby reinforces Ukraine’s bargaining position in future energy negotiations. The route also strengthens Ukraine’s integration with European energy markets and in turn embedding Ukraine more deeply into EU supply networks.

By diversifying supply and linking more closely with European networks, this LNG route not only enhances Ukraine’s energy security against Russia but also supports its longer-term goal of deeper integration with the EU.

Broader Geopolitical and European Energy Implications:

The growing reliance on U.S. LNG is reshaping the energy and geopolitical landscape across Europe. Since Russia’s invasion of Ukraine, many European countries have replaced Russian pipeline gas with LNG, primarily from the United States. The US has become the EU’s first supplier of LNG, with 55% of its LNG supply coming from the US so far in 2025 (12). The US’s dominant position in Europe’s LNG market over the past 3 years has significantly weakened Russia’s standing role as the continent’s main energy supplier and thus has diminished its ability to use gas as a tool of political pressure. The rise of the US’s LNG has also expanded its influence in European energy security. Energy has become a key aspect of US-EU strategic cooperation, alongside defence and sanctions policy. This has clear implications for NATO, as secure and diversified energy supplies are now seen as part of broader collective security and resilience against future threats.

Simultaneously, Europe’s transition towards importing more LNG from the US has in turn influenced power dynamics within the EU itself. Countries such as Greece, which now act as key entry and transit hubs for LNG into Eastern and South-Eastern Europe, are gaining strategic importance within the EU. This enhances their political importance in EU energy discussions and can also lead to more infrastructure investment and regional influence. The success of Greece as an LNG hub also sets a precedent for other aspiring transit states to integrate more deeply into Europe’s energy system.

Overall, the growing influence of the US in Europe’s gas market is further isolating Russia’s economic and diplomatic relations from the EU. With relations between the EU and Russia becoming increasingly tense, it is clear that Europe’s energy future now points toward deeper transatlantic ties and a permanent detachment from Russian gas.

Citations:

1. European Union, 2025

2. Angelos Delivorias, 2025

3. CNBC, 2014

4. U.S. Energy Information Administration, 2023

5. European Commission, 2022

6. Offshore Energy, 2018

7. Nikše, 2025

8. Elliott, 2025

9. Bergman, 2025

10. The Guardian, 2025

11. Liangou, 2025

12. European Commission, 2025