Assessing the Risks: The UK and Small Modular Reactors (SMRs)

By Kaylan Pall

Introduction

Wylfa in Wales has been chosen as the site of Britain's first Small Modular Nuclear Reactors (SMRs). This is a pivotal moment for the British nuclear energy sector, a field that is forced to navigate a volatile regulatory environment and unpredictable pollical headwinds. With energy security and net zero objectives elevating nuclear energy to a position of renewed prominence, Small Modular Reactors offer a scalable and cost-effective solution. SMRs address not only Britain's long-standing challenges with nuclear development but also form a key component of the UK’s nuclear strategy. As the Government unleashes its nuclear vision, this report will highlight the risks stakeholders need to consider.

What are SMRs?

Small Modular Reactors function like traditional nuclear reactors via the process of nuclear fission. SMRs are defined by their smaller electrical capacity, typically not exceeding 300Mwe and by their modular design and construction. The complete reactor modules are manufactured away from the site and are transported for installation. Their compact, replicable design make SMRs a strategic option for energy generation in places where traditional nuclear infrastructure is impracticable. The high degree of standardisation, quality control and “economies of series production” represents a structural shift in the nuclear energy sector. Their modularity enables flexible expansion alongside demand, incrementally increasing units without relying in single decades long mega projects.

The Market

Currently, there are only two SMRs in commercial operation, China and Russia have successfully completed and running sites. With one under construction in Argentina and the recent announcement regarding Wylfa in November, the industry is expanding beyond its testing and theoretical stages. Domestic producers like Rolls Royce SMR provide the UK with a unique opportunity to establish itself as a global leader in civilian commercial nuclear industry.

Globally, the development of SMRs is increasingly driven by small enterprise funded by private capital. Under Net-Zero 2050 scenario, global investment in nuclear energy is projected to exceed USD 150 billion annually. In the UK there are currently nine operational reactors across four sites, supplying 15% of electricity. By 2030 all but one of these reactors are scheduled to be decommissioned. Against this backdrop, SMRs are increasingly viewed as a potential solution to the emerging capacity shortfall. Especially given the limited appetite for constructing traditional nuclear sites.

SMR’s size, scalability and lower capital requirements position them as a commercially attractive option. As a result, SMRs present significant opportunity for stakeholders. The technology is set to experience rapid growth, projections indicating 1000 SMRs deployed globally by 2050, supported by cumulative investment of approximately USD 670 billion.

Risk: Government

Despite welcomed steps to strengthen commercial confidence, like the September US-UK civil nuclear collaboration agreement, significant challenges persist within British nuclear regulatory frameworks. The UK is the most expensive country in the world in which to construct nuclear infrastructure. The 2025 Nuclear Regulatory Taskforce identified a regulatory system that is fragmented, inconsistent and overly bureaucratic, concluding that systematic regulatory failure is the primary driver of delay and cost escalation. Expanding compliance requirements place substantial financial burden onto projects. Excessive and complex regulation, in the form of Environmental Impact Assessments have become a major obstacle to timely project delivery. These factors combined, undermine the core value propositions of SMRs, being lower capital costs achieved through modular design and serial production. As a result, the anticipated advantages of SMRs construction risk being offset. Stakeholders need to monitor how the government acts in creating targeted and streamlined frameworks for SMRs.

While the establishment of Great British Energy Nuclear (GBE-N) and the Prime Minister’s strategic steer signals a clear desire to address regulatory barriers, including a specific intention to unify and “optimise” these initiatives take time. Reforms also remain subject to parliamentary scrutiny and changing political headwinds. The recent budget highlights the government’s readiness to retreat from its growth and business commitments in response to backbench political pressures. Stakeholders therefore need to consider the widening time gap from planning to implantation to shield themselves from shifting policy directions.

Risk: R&D

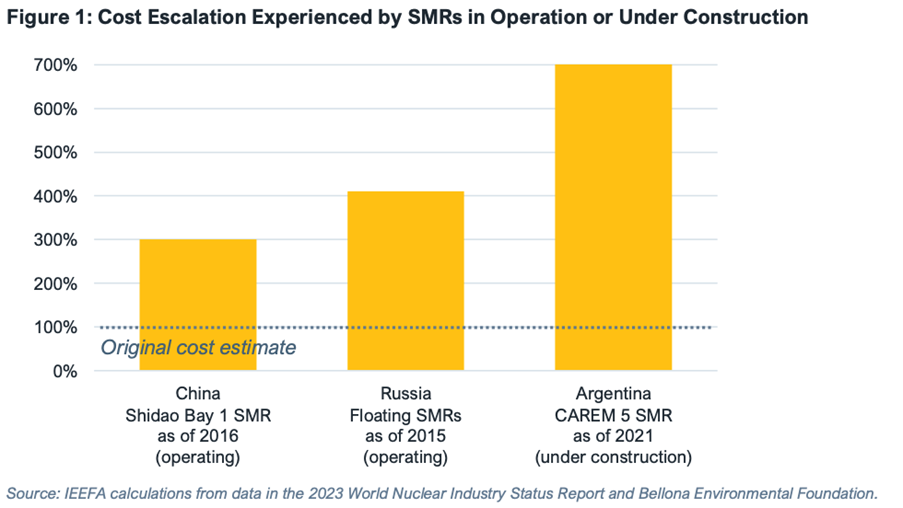

Delivery risk presents a further challenge. SMRs have consistently struggled to meet projected timelines due to first-of-a-kind engineering challenges, licencing delays and immature supply chains. These expose projects to costs before government intervention is considered. Figure 1 shows a sharp increase in actual cost compared to estimates.

The absence of established large-scale manufacturing capacity for SMRs components undermines assumptions around rapid deployment and serial production. Delays in initial iterations risk being replicated across subsequent units, compounding delivery risk rather than reducing it. Stakeholder should assess the extent to which SMRs, in their current state of development, represent a credible solution to energy security and decarbonisation objectives.

Conclusion

SMRs offer a compelling opportunity for investors. However, the case for them relies on effective reform of regulatory frameworks. Prolonged development timelines threaten to erode the economic advantages that underpin the SMRs value proposition. Investors must take into account first of a kind risk. The UK’s position as a later mover within the industry provides valuable opportunities to incorporate valuable lessons from international deployments and avoid replicating known failures. SMRs shouldn’t be viewed as a guaranteed solution, but as a solution with high potential.

Citations

1) BBC News 2025

2) World Nuclear Association: Small Modular Reactors

3) Siemens Energy: Small Modular Reactors

4) IEA: Outlook for Nuclear Investment

5) FT: UK is costliest country to build new nuclear power, government review warns.

6) House of Commons: The new National Policy Statement for nuclear energy generation

7) GOVUK: Prime Minister's strategic steer to the nuclear sector following the 2025 Nuclear Regulatory Taskforce's Review

8) The Telegraph: Don’t be fooled, investors are deeply sceptical of this Budget - Kallum Pickering

9) IEEFA: Small Modular Reactors: Still too expensive, too slow and too risky