Are Tech M&A Deals Delivering Value? An Analysis of Innovation, Pricing, and Post-Deal Outcomes

By Curtis Too

Introduction

The global M&A market has shifted into a more selective and high-stakes phase. Global M&A volume in the first half of 2025 was down 9% year-on-year, while aggregate deal values have risen by roughly 15%, which reflects a bias toward fewer but also larger strategic transactions (Levy, 2025). Within the technology industry, software remains the epicentre of activity, accounting for roughly 80% of all tech M&A in 2023 as companies race to strengthen their capabilities in cloud computing, cybersecurity, AI and data infrastructure (Henry and Van Oostende, 2024).

In this environment, innovation has become increasingly expensive. Large technology firms are routinely paying double-digit revenue multiples and significant equity premiums to secure assets that accelerate their competitive positioning. This report aims at evaluating whether M&A deals are truly delivering value through an analysis of three transactions that illustrate different stages of innovation maturity, strategic intent and valuation discipline.

M&A Deals Case Study (1): Broadcom’s US$61 billion Acquisition of VMware

Deal Overview

On 26 May 2022, Broadcom announced that it would acquire VMware in a cash-and-stock transaction valued at US$61 billion and the assumption of US$8 billion in debt (Broadcom, 2022). After 18 months of global regulatory review, this deal closed on 22 November 2023 with a combined enterprise value of US$69 billion, reflecting adjustments including debt assumption and final share conversion rates.

Strategic Initiative

Broadcom justified the deal as transformative as it would significantly expand Broadcom’s software portfolio and accelerate its shift from a hardware-centric business toward one with a much larger recurring revenue and infrastructure software base (Sayegh, 2024). Once integrated, Broadcom projected that their software revenue would account for a substantial portion of its total revenues, and that the combined entity could target a pro forma EBITDA uplift of up to US$8.5 billion within three years after the deal closed (Investing.com, 2023). Furthermore, this acquisition also provides meaningful cross-sell opportunities across Broadcom’s existing CA Technologies and Symantec assets.

Valuation Analysis

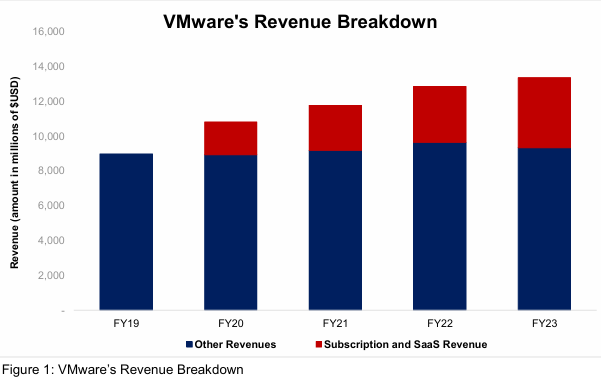

At the time of the May 2022 acquisition announcement, VMware was a mature software company with a growing momentum in its subscription and SaaS transition. VMware’s FY2023 reached US$13.35 billion, with its subscription and SaaS revenue growing at an average of 29% year-on-year, representing an increasingly material share of the business. However, VMware’s license revenue continued its structural decline, which is consistent with its pivot toward recurring, multi-year agreements. VMware’s profitability showed a slight decline to US$2 billion, with a declining operating margin to 15.15%. Other than that, VMware’s services and subscription model produced a robust cash-flow generation, resulting in meaningful leverage but manageable within the profile of a scaled software business.

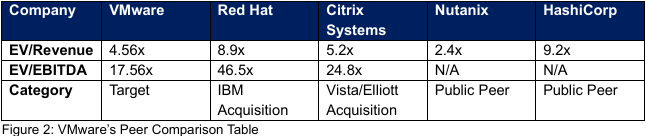

Overall, VMware entered the transaction as a strategically significant, stable-growth infrastructure software asset with improving revenue durability and a strong enterprise footprint. Broadcom’s acquisition valued VMware at US$61 billion in equity value at announcement and approximately US$69 billion in enterprise value after factoring in a net debt of US$8 billion. Using VMware’s LTM revenue base, the deal implies an EV/Revenue multiple of 4.56x. This valuation sits notably above many traditional infrastructure software peers yet below the high-growth SaaS cohort, which reflects VMware’s hybrid profile. On a profitability basis, the deal implies an EV/EBITDA of 17.56x, which is within the typical range for mature, recurring-revenue enterprise software assets and significantly lower than valuations observed in high-premium innovation acquisitions. Broadcom offered an implied 48.9% premium to VMware’s unaffected share price, though the stock had already appreciated prior following leaks of takeover discussions, which suggests that the true economic premium may sit somewhat lower.

Peer Comparison

From the table (Figure 2), we can see that VMware is priced below high-growth infrastructure peers like HashiCorp and well below the Red Hat precedent, but above slower-growth hybrid-cloud peers such as Nutanix. Its EV/EBITDA multiple is more conservative than most precedent transactions, reflecting its moderate growth profile and the significant operational efficiencies that Broadcom is expected to unlock. This positioning suggests that Broadcom paid a strategic control premium but not an excessive innovative premium, which is more in line with transformational platform acquisition than with hypergrowth SaaS deals. The EV/Revenue and EV/EBITDA multiples sit comfortably between high-growth cloud software transactions and legacy infrastructure deals. The combination of VMware’s strengthening subscription and SaaS mix with Broadcom’s ability to materially expand margins reflects a strategic platform valuation.

Post-Deal Performance

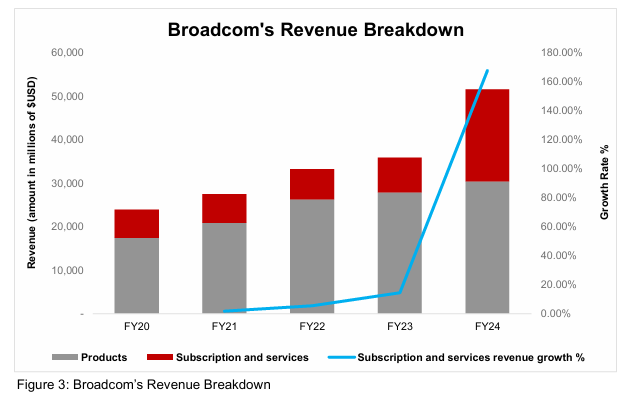

Broadcom’s reported results post-acquisition in November 2023 shows a dramatic shift in the company’s financial profile, driven almost entirely by the consolidation of VMware’s operations. In fiscal year 2024, Broadcom’s subscription and services revenue surged to US$21.22 billion, which represents a 167% increase, while total revenue rose 44.7% to US$51.57 billion. The scale of the expansion reflects VMware’s addition to the software segment, transforming Broadcom from a predominantly hardware-driven business into one where software constitutes a material share of total revenue.

Broadcom’s reported profitability strengthened meaningfully following the VMware integration, with adjusted EBITDA rising to US$31.9 billion in fiscal year 2024, which represents a 37.4% year-on-year growth, and reported free cash flow increasing to US$19.4 billion, which is up 10.1% year-on-year. These headlines figures point to a substantial improvement in earnings and operating cash generation. However, a closer examination of cash flows shows that this strength was accompanied by exceptionally high-investment outflows. Net capital expenditure rose sharply to US$23.1 billion, resulting in a negative free cash flow of US$541 million after net capex on a fully adjusted basis. Despite these near-term financial gains, the post-deal period has been marked by material headwinds. In April 2024, the European Commission requested information from Broadcom over concerns raised by European cloud-service providers about abrupt licensing and support-model changes at VMware, particularly the elimination of perpetual licences in favour of subscription-based bundles (Chee, 2024a). A week later, critics publicly rejected Broadcom’s revised cloud licensing changes, arguing that they failed to address alleged price hikes, unfair terms and product typing (Chee, 2024b). Since then, the Cloud Infrastructure Services Providers in Europe (CISPE) has gone further and filed a legal challenge at the EU General Court seeking to overturn the Commission’s earlier approval of the US$69 billion deal on the grounds that Broadcom’s practices harm competition and cloud customers. Furthermore, customer backlash has also been widely documented. Broadcom has ended perpetual licenses and moved VMware customers onto subscription-based bundles, which is a shift that many enterprises and service providers say has sharply increased costs and reduced flexibility. Industry coverage reports examples of VMware licensing costs rising by several hundred percent and notes that a large majority of customers are now at least evaluating alternatives, even if actual churn remains limited so far (Niel, 2024).

Conclusion

Therefore, Broadcom’s fiscal year 2024 results indicate strong early financial performance post-acquisition, with infrastructure software contributing substantially to overall revenues and margins. However, the sustainability of these gains remains contingent on resolving customer dissatisfaction and regulatory challenges, which introduces execution risk alongside financial upside.

M&A Deals Case Study (2) : Cisco’s US$28 billlion Acquisition of Splunk

Deal Overview

On 21 September 2023, Cisco announced a definitive agreement to acquire Splunk in an all-cash transaction at approximately US$28 billion, paying US$157 per share and representing a 31% premium to Splunk’s last closing price prior to the announcement. Following regulatory approvals, including unconditional clearance from the European Commission, Cisco completed the acquisition on 18 March 2024, at which Splunk’s shares were delisted, becoming part of Cisco’s security and observability portfolio (Cisco, 2024).

Strategic Initiative

Cisco justified the acquisition as a strategic move to combine its strengths in networking and security with Splunk’s leading position in security analytics, SIEM (Security Information and Event Management) and observability, framing this as a way to make organisations more secure and resilient in an AI-powered world by unifying network, security and observability data into a single analytics fabric (Cisco, 2023). Furthermore, Cisco has stated that it expects the deal to be cash-flow positive and non-GAAP gross-margin accretive in fiscal year 2025, post close, and non-GAAP EPS accretive in fiscal year 2026, while also accelerating its revenue growth and gross margin expansion. Cisco executives expect to see an increase of US$4 billion in annual recurring revenue from Splunk’s subscription-heavy model (Milana et al., 2023).

Valuation Analysis

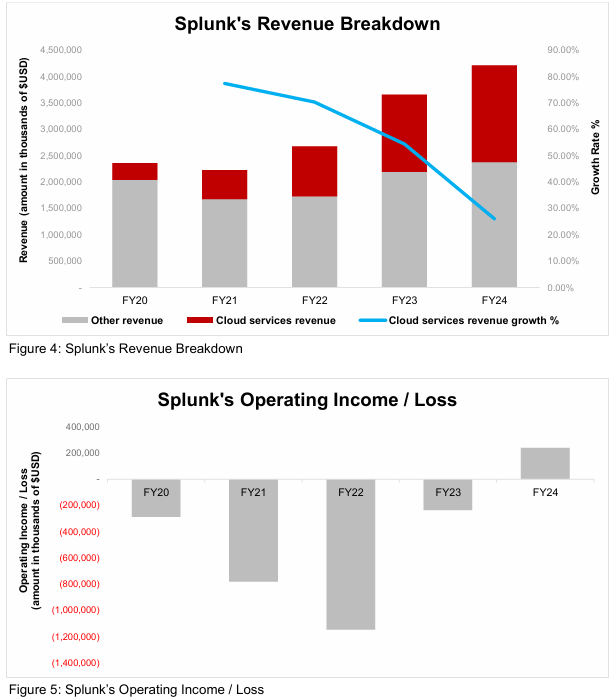

At the time of the deal, Splunk was well advanced in its transition to a subscription and cloud based model. Its fiscal year 2024 financials reported US$4.22 billion in total revenue, reflecting a 15.3% year-on-year growth, with cloud services revenue contributing US$1.84 billion. Although cloud revenue continued to expand, its growth rate moderated each year as the business scaled, and the mix shifted towards larger, multi-year enterprise contracts. Splunk’s profitability trajectory also reflected the financial impact of this multi-year cloud transition as its operating income had been negative for several consecutive fiscal periods, with its fiscal year 2023 recording an operating loss of US$235.51 million before returning to positive territory in fiscal year 2024.

Overall, although Splunk’s operating leverage was not yet fully improving at the announcement of the acquisition, it had clearly entered the late stages of its cloud transition. Cisco’s valuation therefore reflected Splunk’s recurring revenue strength, growing cloud ARR and long-term margin potential, rather than its near-term profitability. Furthermore, Cisco’s acquisition price reflects a strategic rather than purely financial valuation. The EV/Revenue multiple of 5.63x is consistent with high-demand cybersecurity and observability assets, where mission-critical analytics and AI-driven detection capabilities command a premium. On a profitability basis, the EV/EBITDA multiple of 126.18x appears extremely high, but this is largely due to Splunk’s low EBITDA base during its cloud transition. Thus, Cisco’s justification focuses instead on ARR and long-term cash-flow generation, and relative to its peers and strategic relevance, this valuation signals that Cisco was willing to pay a meaningful premium for Splunk’s dominant SIEM position, AI-ready data lake capabilities and recurring revenue base. The premium also reflects Splunk’s strategic fit with Cisco’s long-term pivot to software, security and observability, which are value drivers that outweigh short-term EBITDA dilution.

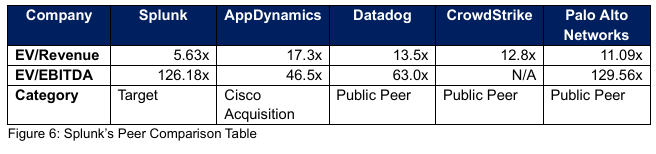

Peer Comparison

From the table (Figure 6), we see that Cisco’s valuation of Splunk sits meaningfully below the multiples of high-growth observability peers such as Datadog and cybersecurity leaders like CrowdStrike, both of which command premium valuations driven by stronger ARR growth and cloud-native architectures. Compared with Palo-Alto Networks, Splunk’s lower revenue multiple reflects its more moderate growth and the financial impact of its cloud transition, while its elevated EBITDA multiple is largely a function of temporarily depressed earnings. Against precedent transactions such as AppDynamics, Splunk appears conservatively priced relative to category-defining observability deals. Overall, the peer set indicates that Cisco paid a strategic but defensible premium, positioning Splunk closer to mature enterprise security assets than to hypergrowth observability cohort.

Post Deal Performance

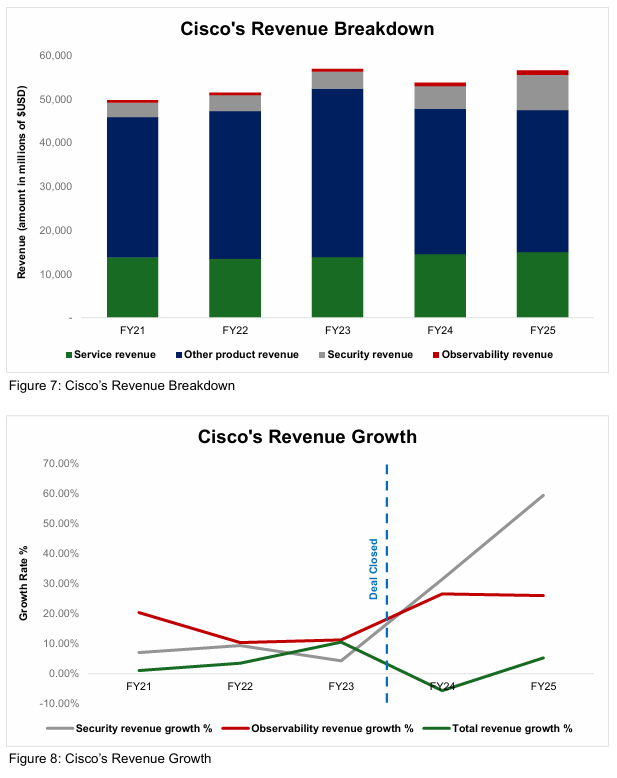

Cisco’s early post-acquisition results show a decisive shift towards a more software and security centric revenue profile. In fiscal year 2024, Cisco’s security revenue increased 31.5% year-on-year, rising from US$3.86 billion to US$5.07 billion, while observability revenue grew by 26.7% to US$837 million. This momentum accelerated in fiscal year 2025, with Cisco’s security revenue climbing a further 59.5% to US$8.09 billion and observability revenue expanding 26.1% to US$1.06 billion. Although Cisco does not disclose Splunk’s performance as a standalone item, these pronounced year-over-year gains strongly suggest Splunk’s material early contribution to both segments. By contrast, Cisco’s total revenue growth remained subdued across the period, with overall growth flattening in fiscal year 2024 before recovering only modestly in fiscal year 2025. This divergence highlights that the strong acceleration in security and observability revenues has been partially offset by softness in Cisco’s larger hardware-oriented product revenues. Thus, as a result, Splunk’s contribution has materially strengthened Cisco’s strategic software segments without yet translating into a proportionate uplift in consolidated revenue growth.

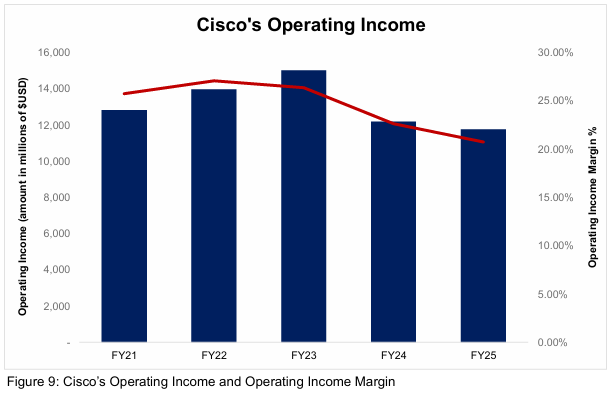

Cisco’s profitability also remained resilient through the integration period. The company reported operating income of US$12.18 billion in fiscal year 2024 and US$11.76 billion in fiscal year 2025, although lower than its fiscal year 2023 results but it is still indicative of robust margin strength in the face of a large cash acquisition and integration-related expenses. Gross margins held steady at around 64.8%, while operating expenses increased in line with Splunk’s incorporation into Cisco’s cost structure. Cisco reaffirmed its guidance that the deal will be non-GAAP EPS-accretive in fiscal year 2026, supported by Splunk’s long-term subscription economics and ongoing efficiency measures across the combined security and observability portfolio.

At the same time, several headwinds and uncertainties temper the otherwise strong quantitative contribution. Industry analysts note that Cisco remains in the early phases of integrating Splunk, with much of the expected value creation is still largely conceptual and not yet demonstrated at an operational scale (Boyd, 2025).

Conclusion

Overall, Cisco’s early post-deal performance demonstrates that the Splunk acquisition is meaningfully strengthening its security and observability portfolio, accelerating its pivot toward high-margin recurring software revenue. However, whether the deal ultimately delivers its full strategic and financial potential in the upcoming years will depend on Cisco’s ability to translate early momentum into sustained operational synergies, customer adoption and demonstrable value at scale over the coming years.

M&A Deals Case Study (3): Alphabet’s US$32 billion Acquisition of Wiz

Overview

On 18 March 2025, Alphabet announced its intent to acquire Wiz in an all-cash transaction valued at US$32 billion, representing one of the largest cybersecurity deals ever undertaken. The acquisition is designed to fold Wiz’s leading cloud-native security and CNAPP (cloud native application protection platform) capabilities into Google Cloud, reinforcing Alphabet’s ambition to make Google Cloud a top-tier enterprise security platform. Regulatory reviews are expected in multiple jurisdictions, and completion is subject to approval. As of now, the deal remains pending.

Strategic Initiative

Alphabet’s acquisition of Wiz is driven by its ambition to strengthen Google Cloud’s position in enterprise cybersecurity by integrating a leading cloud-native application protection platform into its core infrastructure. Google’s announcement indicates that the company intends to enhance its ability to provide unified visibility, threat detection and risk assessment across multiple cloud environments, which has become an essential requirement for large enterprises operating workloads across AWS, Azure and Google Cloud (Google, 2025). This combination will allow Wiz to scale its security graph and agentless CNAPP architecture more rapidly, which enables this joint organisation to secure every layer of the cloud and deliver more comprehensive protection for modern applications (Rappaport, 2025). Wiz can be viewed as a strategic asset that can accelerate Google Cloud’s competitiveness against major cybersecurity and cloud providers. There are high expectations that Wiz will strengthen Google’s capabilities in AI-enabled threat detection and help address rising enterprise demand for integrated cloud-security solutions at a time when cyber risks and regulatory scrutiny are intensifying (Sophia and Hu, 2025). Overall, this deal signals Alphabet’s commitment to elevating Google Cloud’s security capabilities and building greater credibility with enterprise customers by pairing its scale with Wiz’s rapid innovation and multi-cloud reach.

Valuation Analysis

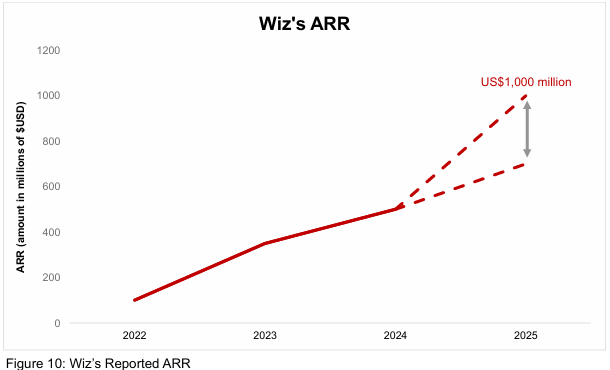

Alphabet’s proposed US$32 billion acquisition of Wiz is widely regarded as one of the richest cybersecurity valuations on record. As Wiz is a privately held company with limited financial disclosures, the transaction value is generally treated as a proxy for enterprise value when calculating valuation multiples. Public estimates place Wiz’s ARR at US$500 million in 2024, rising from US$100 million in 2022 and US$350 in 2023, which implies an EV/ARR multiple of around 64x on a trailing basis (Odum, 2024). Some recent reporting, including the Financial Times, suggests that Wiz may have already reached US$700 million in ARR by the time the transaction was announced, which would still equate to an EV/ARR multiple in the mid-40x range (Levingston et al., 2025). Even at the higher ARR figure, the price represents one of the highest revenue multiples ever observed in large cybersecurity M&A (K Chirayll et al., 2025).

Wiz underlying financial profile helps to explain why Alphabet was willing to pay such a premium. It is one of the fastest-growing security startups globally, having scaled from US$100 million to an estimated US$500 million in ARR in roughly two years, with investors and analysts expecting it to reach US$1,000 million in ARR in 2025 (Levingston et al., 2025). From Alphabet’s perspective, the acquisition price of US$32 billion reflects not only on Wiz’s current ARR base but also its exceptional growth trajectory and its strategic value in closing a key gap in Google Cloud’s security portfolio. Analysts suggested that this is a strategically important transaction for Alphabet as they are effectively paying for a rare combination of hyper-growth, category leadership in cloud-native security, and the potential to reshape Google Cloud’s competitive position over the medium term (Ojha, 2025).

Peer Comparison

Comparing Wiz with both startups and public cybersecurity peers helps us to illustrate why Alphabet was willing to pay such a substantial premium. Based on estimates of Wiz’s US$500 million in ARR in 2024, which equates to an EV/ARR multiple of 64x, this places Wiz at the very high end of the cloud-security landscape. When viewed alongside other fast growing CNAPP and cloud-native security startups, this premium is significant but not without precedent. For example, Lacework reached a US$8.3 billion valuation despite generating a far smaller revenue base, which demonstrates how private markets have historically rewarded cloud-security companies that are perceived as category leaders (Odum and Aghdasi, 2023). Similarly, Orca Security, which is one of Wiz’s closest competitors in agentless cloud-security, has also achieved billion-dollar valuations while scaling quickly, though at a more moderate pace than Wiz (Wu, 2025). Another instance would be Aqua Security’s US$1 billion valuation at its 2021 Series E round, which marked an early milestone for cloud-infrastructure security startups (Chowdhry, 2021). Its subsequent US$60 million in additional funding in 2024 reaffirmed continued investor confidence in the CNAPP segment and confirmed that Aqua’s valuation sits above US$1 billion threshold (Aqua, 2024). Collectively, these comparisons show that while Wiz sits at the upper end of the private-market multiples, its valuation aligns with the premium that investors have historically assigned to perceived long-term winners in cloud security. When compared with public cybersecurity firms, the scale of Alphabet’s premium becomes even more apparent. CrowdStrike and Zscaler, which are two of the most successful and scalable public cybersecurity companies, typically trade at revenue multiples in the mid teens. These firms benefit from far larger revenue bases, proven operating leverage and long-established enterprise distribution, which naturally anchors their valuations to more conservative public-market norms. By contrast, Wiz is still in a hyper-growth phase, and its valuation reflects expectations of continued rapid expansion, strong technological differentiation and a strategic role within Google Cloud’s long-term security roadmap. In this sense, public-company multiples offer only a partial benchmark. Alphabet’s decision to pay a premium well above both public peers and most private-market transactions suggests that the company views Wiz not merely as a high-growth startup but as a foundational asset capable of reshaping Google Cloud’s competitive position in multi-cloud security.

Conclusion

Alphabet’s agreement to acquire Wiz for US$32 billion represents one of the most aggressive valuation bets seen in cybersecurity, but it is also strategically coherent when set against Google Cloud’s competitive position. On most estimates, Wiz had around US$500 million in ARR by mid-2024 and was valued at US$12 billion in its latest funding rounds (Rappaport, 2024). This implies that Alphabet is paying a multiple in the range of 45-65x ARR, which is significantly above both public cybersecurity leaders and most private cloud security peers. Analysts who view the deal favourably argue that the premium reflects not current financials, but Wiz’s rare combination of hyper-growth, technical differentiation in agentless CNAPP and deep penetration into large enterprises with a customer base that includes a substantial portion of the Fortune 100 (Harel, 2024). From this perspective, Alphabet is effectively paying for the opportunity to close a strategic gap in Google Cloud’s security stack and to reposition itself more credibly against Microsoft and other established competitors over the medium term (Sayegh, 2025).

At the same time, market reaction and early commentary highlight that this transaction is far from risk-free. Some investors and commentators have questioned the capital outlay and the steep multiple, noting that the purchase price equates to well over 30 times Wiz’s projected 2025 revenue and consumes a material share of Alphabet’s cash and annual free cash flow (Sayegh, 2025). There are also concerns about whether Google can integrate Wiz without dampening its innovation pace, whether it can preserve Wiz’s multi-cloud neutrality in practice, and how the acquisition may amplify existing competitive and regulatory pressures surrounding Google’s expanding role in cloud security. In aggregate, this deal should be viewed as a high-conviction strategic investment rather than a purely financial transaction. Its ultimate success will depend less on whether the headline multiple appears rich today and more on whether Alphabet can translate Wiz’s momentum into sustained enterprise security wins, incremental Google Cloud share gains and a durable perception among customers that Google has become a first-tier, security-led cloud provider.

Synthesis and Strategic Implications

Across the three acquisitions that we have gone through, a clear narrative emerges about the changing nature of value creation in technology M&A. These transactions show that large technology firms are becoming increasingly willing to pay significant premiums not for short-term financial gains, but for platforms that reshape their long-term strategic positioning. Each case represents a different stage of maturity, integration visibility and risk, yet together they reveal how cloud infrastructure, data analytics and cybersecurity have become the core battlegrounds for competitive advantage.

Firstly, Broadcom’s acquisition of VMware illustrates how transformational M&A in mature markets can deliver immediate financial benefits when the acquirer has a disciplined integration model. VMware’s recurring revenue base and established enterprise presence allowed Broadcom to expand margins and cash flow rapidly, although the integration also triggered customer backlash and regulatory scrutiny. Secondly, Cisco’s acquisition of Splunk highlights how data and security capabilities are increasingly central to enterprise value. Splunk’s contribution strengthened Cisco’s security and observability portfolio, offsetting hardware softness and accelerating the company’s shift toward high-margin recurring revenue. Lastly, Alphabet’s proposed acquisition of Wiz represents the frontier of innovation driven dealmaking, which is an extraordinarily high valuation for a hypergrowth cloud security platform that Alphabet views as essential to elevating Google Cloud’s competitiveness. Because the deal remains pending, Alphabet faces considerable uncertainty but yet it demonstrates a willingness to pursue transformative bets when the technology aligns with long-term strategic goals.

Key Takeaways Across the Three Case Studies

• Recurring revenue models and data-control layers command the highest premiums: Splunk and VMware show that buyers place significant value on predictability, stickiness and enterprise dependency. Wiz extends this logic by showing that even earlier-stage assets can justify extreme multiples when they offer a long-term strategic advantage.

• AI, security and observability are now foundational to platform competitiveness: These deals collectively emphasise that companies controlling telemetry, threat detection and cloud workload visibility will shape the next decade of enterprise IT. Acquisition targets are increasingly judged not by their standalone performance but by how well they strengthen the acquirer’s ecosystem.

• Integration discipline determines whether high valuations translate into real value: Broadcom’s swift financial gains illustrate one approach; Cisco’s early but still incomplete integration of Splunk reflects another; and Alphabet’s pending acquisition of Wiz highlights the risks of acquiring fast-moving startups. Across these cases, maintaining innovation velocity and customer trust is essential to capturing long-term value.

Strategic Implications and Outlook

The analysis of these transactions highlights that successful technology M&A increasingly depends on an acquirer’s ability to align valuation with the maturity of the innovation being purchased. Paying ahead of operational readiness or without a credible integration plan risks eroding value, while delaying action in fast-moving markets can leave firms structurally disadvantaged. Disciplined integration strategies that protect technical talent, maintain product momentum and preserve customer experience are therefore becoming essential components of long-term value creation.

Interpreting valuation multiples through a forward-looking strategic lens is equally important. Assets that control critical layers of the digital ecosystem such as cloud security, observability and AI-driven analytics continue to command outsized premiums because they anchor future competitive positioning. However, high valuations alone does not ensure success, as careful evaluation of integration challenges, regulatory considerations and customer responses remains essential to determining whether such premiums can be sustained over time.

Furthermore, these acquisitions underscore how the technology landscape is being reshaped for enterprise users. Shifts in ownership often lead to changes in licensing frameworks, support models and product roadmaps, particularly when absorbed into large cloud providers or firms known for assertive post-deal restructuring. Organisations must therefore prepare for evolving cost structures and evaluate the long-term implications vendor lock-in, interoperability constraints and product continuity.

Altogether, the three case studies demonstrate that technology M&A is moving decisively toward capability-driven strategy. Companies are no longer acquiring primarily for scale but to secure assets that accelerate platform evolution and strengthen strategic control points. Whether through consolidating recurring revenue bases, expanding security and observability portfolios or capturing the next inflection point in cloud innovation, these acquirers are positioning themselves for long-term advantage. Ultimately, the firms that derive the greatest value from such transactions will be those that pair bold strategic intent with disciplined execution and a sustained commitment to delivering superior outcomes for customers.